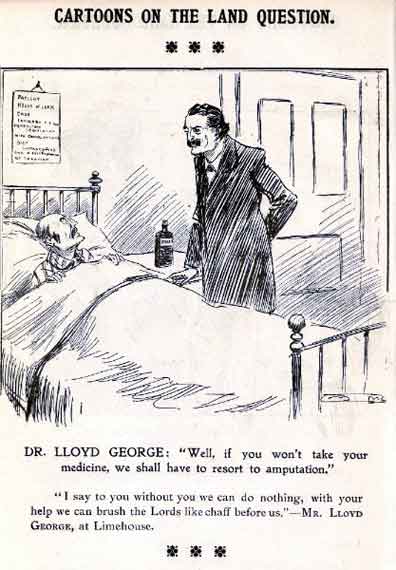

All the points made by Lloyd George in his 1909 Limehouse speech hold good today. This time the villains are not Tory dukes, but publicly subsidised plc house builders with their ludicrously over-remunerated executives creating investment assets in ordinary families’ homes and then selling the freeholds to secretive organisations, often based offshore. It is utter madness. A waste of public money, which could be spent on other housing needs rather than bogus home ownership through leasehold. When is this going to stop?

Here is a brilliant BBC R4 programme from 1986, talking about leasehold houses in Wales and the essential unfairness involved.

Gareth Wardell, Labour MP for Gower speech, had made a speech on January 14 1986 which referenced two other champions of leaseholders: Lloyd George, who was a solicitor, and George Thomas, a future Speaker of the Commons.

Thanks to Twitter user LeaseLad for bringing it to our attention:

Here is Lloyd George speaking in Limehouse on July 30 1909 in defence of his People’s Budget, which the Lords disastrously opposed – prompting the reform which deprived them of the right to consider financial Bills in future.

Here is Lloyd George speaking in Limehouse on July 30 1909 in defence of his People’s Budget, which the Lords disastrously opposed – prompting the reform which deprived them of the right to consider financial Bills in future.

“Look at all this leasehold system. This system it is the system I am attacking, not individuals

is not business, it is blackmail …“What are they ? Ground rent is a part of it fines, fees ; you are to make no alteration without somebody’s consent.

“Who is that somebody? It is the agent of the landlord. A fee to him.

“You must submit the plans to the landlord’s architect, and get his consent. There is a fee to him.

“There is a fee to the surveyor ; and then, of course, you cannot keep the lawyer out. He always comes in. And a fee to him.

“Well, that is the system, and the landlords come to us in the House of Commons, and they say : “If you go on taxing reversions we will grant no more leases.”

“Is not that horrible ? No more leases, no more kindly landlords, with all their retinue of good fairies agents, surveyors, lawyers, ready always to receive ground rents, fees, premiums, fines, reversions …”

Nothing much, except that we are creating leasehold tenure on an industrial scale as the English, particularly in the South East, move from being owners of houses to living in flats, as is the case in most advanced societies around the world.

The leasehold houses scandal, with Taylor Wimpey, Countryside Properties plc and Redrow introducing doubling ground rents, was the final piss-take too far.

Oh, and don’t forget Persimmon, which spread the scourge of leasehold houses across the country, with high but not doubling ground rents. They did this with a massive taxpayer subsidy through Help To Buy and then the senior executives helped themselves to the kind of multi-million pound bonuses that would have shamed the Tory dukes and lords who Lloyd George was attacking.)

And here is what Gareth Wardell told the Commons in 1986:

“A ground landlord buys a freehold for perhaps £300. On site is a house for which the owner paid, say, £30,000. The home owner pays the landlord ground rent of perhaps £30 a year, but the power of the landlord is disproportionate to the interest that he has purchased in that property. In return for allowing a home to be on his land, the landlord can insist on an amazing number of restrictions and obligations from the tenant.

“As the report of the Building Societies Association on leaseholding states: “An Englishman’s home, if held on Leasehold, is his landlord’s castle.”

“I am sure that the same is true of the Welshman’s home.”

Debate is here:

http://www.ukpol.co.uk/gareth-wardell-1986-speech-on-leasehold-reform/

SPEECH ON THE LAND AND THE PEOPLE Delivered at Limehouse, July 30, 1909

The two following speeches, delivered at Limehouse, was made during Mr. Lloyd George’s Budget campaign, and before the Budget had reached the House of Lords (where it was rejected, provoking the reform of the Lords.

A FEW months ago a meeting was held not far from this hall, in

the heart of the City of London, demanding that the Government

should launch into enormous expenditure on the Navy. That

meeting ended up with a resolution promising that those who

passed that resolution would give financial support to the Government

in their undertaking. There have been two or three meetings held in the

City of London since attended by the same class of people, but not ending

up with a resolution promising to pay. On the contrary, we are spending

the money, but they won’t pay. What has happened since to alter their

tone ? Simply that we have sent in the bill. We started our four ” Dread-

noughts.” They cost eight millions of money. We promised them four

more ; they cost another eight millions. Somebody has to pay, and then

these gentlemen say, ” Perfectly true ; somebody has to pay, but we would

rather that somebody were somebody else.” We started building ; we

wanted money to pay for the building ; so we sent the hat round. We

sent it round amongst workmen, and the miners and weavers of Derbyshire

and Yorkshire, 1 and the Scotchmen of Dumfries, who, like all their country-

men, know the value of money, they all dropped in their coppers. We

went round Belgravia, and there has been such a howl ever since that it

has well-nigh deafened us.

But they say, ” It is not so much the ‘ Dreadnoughts ‘ we object to, it

is pensions.” If they objected to pensions, why did they promise them ?

1 A reference to the by-elections which took place in Derbyshire, Yorkshire, and

Dumfries a few days before this speech was delivered, when the main issue before

the electors was the Budget, which in all three divisions was supported by substantial

majorities.

They won elections on the strength of their promises. It is true they never

carried them out. Deception is always a pretty contemptible vice, but

to deceive the poor is the meanest of all. They go on to say, ” When we

promised pensions we meant pensions at the expense of the people for

whom they were provided. We simply meant to bring in a Bill to compel

workmen to contribute to their own pensions.” If that is what they meant,

why did they not say so ? The Budget, as your chairman has already so

well reminded you, is introduced not merely for the purpose of raising barren

taxes, but taxes that are fertile, taxes that will bring forth fruit the security

of the country which is paramount in the minds of all. The provision for

the aged and deserving poor was it not time something was done ? It

is rather a shame that a rich country like ours probably the richest in the

world, if not the richest the world has ever seen should allow those who

have toiled all their days to end in penury and possibly starvation. It is

rather hard that an old workman should have to find his way to the gates

of the tomb, bleeding and footsore, through the brambles and thorns of

poverty. We cut a new path for him an easier one, a pleasanter one,

through fields of waving corn. We are raising money to pay for the new

road aye, and to widen it so that 200,000 paupers shall be able to join

in the march. There are many in the country blessed by Providence

with great wealth, and if there are amongst them men who grudge out of

their riches a fair contribution towards the less fortunate of their fellow-

countrymen they are very shabby rich men.

We propose to do more by means of the Budget. We are raising money

to pro vide against the evils and the sufferings that follow from unemployment.

We are raising money for the purpose of assisting our great friendly societies

to provide for the sick and the widows and orphans. We are providing

money to enable us to develop the resources of our own land. I do not

believe any fair-minded man would challenge the justice and the fairness

of the objects which we have in view in raising this money.

Some of our critics say, ” The taxes themselves are unjust, unfair, un-

equal, oppressive notably so the land taxes.” They are engaged, not

merely in the House of Commons, but outside the House of Commons,

in assailing these taxes with a concentrated and a sustained ferocity which

will not allow even a comma to escape with its life. Now, are these taxes

really so wicked ? Let us examine them ; because it is perfectly clear

that the one part of the Budget that attracts all this hostility and animosity

is that part which deals with the taxation of land. Well, now let us examine

it. I do not want you to consider merely abstract principles. I want to

invite your attention to a number of concrete cases ; fair samples to show

you how in these concrete illustrations our Budget proposals work. Let

us take them. Let us take first of all the tax on undeveloped land and on

increment.

Not far from here, not so many years ago, between the Lea and the

Thames, you had hundreds of acres of land which was not very useful

even for agricultural purposes. In the main it was a sodden marsh. The

commerce and the trade of London increased under Free Trade, the ton-

nage of your shipping went up by hundreds of thousands of tons and by

millions ; labour was attracted from all parts of the country to cope with

all this trade and business which was done here. What happened ? There

was no housing accommodation. This Port of London became overcrowded,

and the population overflowed. That was the opportunity of the owners

of the marsh. All that land became valuable building land, and land

which used to be rented at 2 or 3 an acre has been selling within the last

few years at 2,000 an acre, 3,000 an acre, 6,000 an acre, 8,000 an acre.

Who created that increment ? Who made that golden swamp ? Was

it the landlord ? Was it his energy ? Was it his brains a very bad

look-out for the place if it were his forethought ? It was purely the

combined efforts of all the people engaged in the trade and commerce of

the Port of London trader, merchant, shipowner, dock labourer, workman

everybody except the landlord. Now, you follow that transaction.

Land worth 2 or 3 an acre running up to thousands. During the time

it was ripening the landlord was paying his rates and his taxes not on 2

or 3 an acre. It was agricultural land, and because it was agricultural

land a munificent Tory Government voted a sum of two millions to pay half

the rates of those poor distressed landlords, and you and I had to pay taxes

in order to enable those landlords to pay half their rates on agricultural

land, while it was going up every year by hundreds of pounds through your

efforts and the efforts of your neighbours.

That is now coming to an end. On the walls of Mr. Balfour’s meeting

last Friday were the words, ” We protest against fraud and folly.” So

do I. These things I tell you of have only been possible up to the present

through the ” fraud ” of the few and the ” folly ” of the many. What

is going to happen in the future ? In future those landlords will have to

contribute to the taxation of the country on the basis of the real value

only one halfpenny in the pound ! Only a halfpenny ! And that is what

all the howling is about.

There is another little tax called the increment tax. For the future

what will happen ? We mean to value all the land in the kingdom. And

here you can draw no distinction between agricultural land and other land,

for the simple reason that East and West Ham was agricultural land a few

years ago. And if land goes up in the future by hundreds and thousands

an acre through the efforts of the community, the community will get

20 per cent, of that increment. Ah ! what a misfortune it is that there was

not a Chancellor of the Exchequer to do this thirty years ago ! We should

now have been enjoying abundant revenue from this source.

I have instanced West Ham. Let me give you a few more cases. Take

cases like Golder’s Green and others of a similar kind where the value of

land has gone up in the course, perhaps, of a couple of years through a

new tramway or a new railway being opened. Golder’s Green to begin

with. A few years ago there was a plot of land there which was sold at

160. Last year I went and opened a tube railway there. What was the

result ? This year that very piece of land has been sold for 2,100 160

before the railway was opened before I went there 2,100 now. My

Budget demands 20 per cent, of that.

There are many cases where landlords take advantage of the needs of

Is Salisbury Cathedral justified in putting the squeeze on leaseholders living on its close?

Is Salisbury Cathedral justified in putting the squeeze on leaseholders living on its close?