UPDATED with weekend press reports (see below)

Why is ex-headteacher, 85, allegedly seeing his ground rent rise from £50pa to £8,000pa?

Since December last year, the Leasehold Knowledge Partnership has been contacted by National Trust leaseholders – there are around 300 in total – some of whom face crippling rises in ground rent.

Since December last year, the Leasehold Knowledge Partnership has been contacted by National Trust leaseholders – there are around 300 in total – some of whom face crippling rises in ground rent.

The issue has not been made public by us as representatives of the National Trust leaseholders could never agree whether or not to make the issue public. Furthermore, we were swamped by the new-build ground rent scandal.

We even produced a survey for National Trust leaseholders, which can be completed here

Today the issue of National Trust leaseholders appeared on the front page of The Times:

National Trust raises tenants’ rent demands by up to 10,000%

The National Trust has been accused of profiteering after hundreds of leasehold tenants were told that they faced ground rent increases of up to 10,000 per cent. The Tenants Association of the National Trust is demanding an inquiry into the conduct of the country’s biggest conservation charity after an 87-year-old resident was informed that his payments would rise from £148 to £15,000 a year.

Many National Trust leaseholders – who bought long-term tenancies to often dilapidated estate houses, many of no particular historic worth – do feel that they have been treated unfairly.

We were concerned to speak to an 86-year-old former headteacher living in a cottage with his disabled, middle-aged son in Devon where the National Trust is the freeholder. Next year his ground rent rises from £50pa to £8,000 a year.

Many of the leasehold properties were sold in the 1970s and 1980s in states of dilapidation.

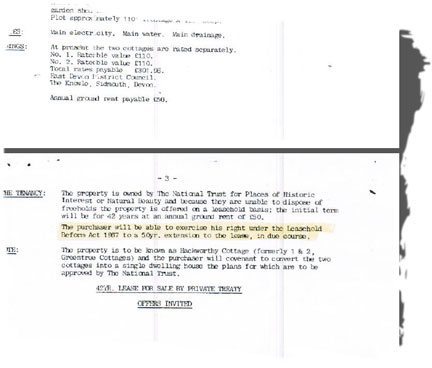

They were sold on long leases of 49 years, with the National Trust at the time and for long afterwards indicating to putative buyers that the leases could be extended “free of charge” by another 50 years, a statutory extension under the 1967 Act.

Buyers were told that this arrangement, as opposed to issuing a 99-year lease at outset, was to discourage short-term ownership and speculation in National Trust residential property.

Many leaseholders then spent thousands transforming these properties. Most are estate and farmworkers’ cottages. The epicentre for the dispute was the Killerton estate, in Devon.

It is clear that the National Trust encouraged sales on this two-stage basis.

At some stage, the National Trust called in more commercially minded property professionals – doubtless thinking of themselves more grandly as “asset managers” – and suddenly a notion of “modern ground rent” was introduced.

It appears that the National Trust did not hike the ground rents until, perhaps, June 2014.

A letter of June 11 2014 of David Jenkins, a chartered surveyor and a National Trust consultancy manager, says that:

“The National Trust considers it right to charge the modern ground rent where it applies, and that we plan to do so.

“However, we do understand that when some long lease tenants bought their properties the tenants’ own lawyers or surveyors may not have explained fully – as they should have done – how modern ground rent works. So we are trying to be flexible about how we help tenants to deal with the situation where these charges have taken them by surprise.”

This is not accurate, according to the leaseholders.

It is rather fanciful to think that solicitors, or other advisers, could have given much useful guidance on ground rents (in rural Devon): the scandal over new-build properties demonstrates that this is a niche, specialist area of residential property which few understand (conveyancing solicitors and even mortgage lenders included).

The National Trust itself was not applying increased ground rents in its lease extensions until two years ago.

The leaseholders claim that there is considerable inconsistency: the 86-year-old gentleman’s 49 year initial lease that terminates next year faces £8,000pa in ground rent; a neighbour whose statutory lease extension begins in 2025 faces only £2,000 a year.

Those who have more recently purchased a 49-year lease face even lower ground rents when the 50-year statutory lease extension kicks in.

Leaseholders made a formal complaint to the Charity Commission concerning these issues last year. Its annual report states:

“We enabled the National Trust to treat tenants of their properties in a fair, moral way. Had we not done so a number of tenants in around 300 properties might have had difficulty in paying increased rents.”

As a result of this decision, the National Trust has allowed some residents to buy out their “modern ground rents” at a 50 per cent discounted rate.

“The Trusts proposals are intended to help people who have been taken by surprise by the impact of modern ground rent,” according to David Jenkins, a consultancy manager for the National Trust.

Leaseholders are clearly very unhappy with this state of affairs, telling the Charity Commission:

“In your case study, you say that the impact of your involvement has enabled the National Trust to treat tenants of their properties in a fair, moral way and had you not done so a number of tenants in around 300 properties might have had difficulty in paying increased rents.

“Can you please tell us how the Charity Commission thinks that reducing a modern ground rent buy-out figure for an 86-year old man from £82,000 to £41,000, or paying £4,800 every year rather than £9,600, from an original ground rent of £50, does not present a difficulty?”

In the past, the National Trust was telling its leaseholders that these 50-year extensions to their leases were “free of charge”. It repeatedly emphasised this extension as “free”.

In a now deleted National Trust website page (attached, para 2) states:

“The requirements of the Leasehold Reform Act 1967 are complicated but broadly if your lease is for more than 21 years with a rent of less than £250 a year and you have owned it for at least 2 years then you may be able to claim the free fifty year extension to your lease.”

Again, there is no indication that ground rents would drastically increase.

A separate issue concerns the granting of ‘’voluntary extensions’’ after the 49-year initial lease and the 50-year statutory extension.

The “i” newspaper reports the issue like this:

Hundreds of households have faced ‘ludicrous’ ground rent increases

The National Trust’s property managers have been accused of “thinking they are asset managers” after hundreds of households faced “ludicrous” ground rent increases of up to 10,000 per cent. The Tenants Association of the National Trust has called for an inquiry into the conservation organisation’s practices after people who have been living on National Trust land for decades were faced with sudden increases in costs.

The Daily Mail reports the issue:

National Trust raised 87-year-old’s yearly rent from £148 to £15,000

He was told he’d have to find £78,000 to buy out the higher ground rent Conservative Ed Vaizey says his constituent faced a rise from £50 to £5,000 Leaseholders say the were told leases can be extended for 50 years at no cost The Charity Commission no longer requires the trust to maximise income Over 10,000 people live 5,000 in homes on National Trust land Tenants are demanding an inquiry after the National Trust told an 87-year-old his annual ground rent would rise from £148 to £15,000.

And then the Mail on Sunday also joined the fray:

National Trust is sitting on £1bn fortune as it raises RENT to tenants

The National Trust is sitting on investments worth more than £1 billion It also leading for donations and raising rents for tenants by up to 10,000 % The portfolio of investments is guarded by half a dozen leading fund managers The National Trust is sitting on investments worth more than £1 billion while pleading for donations and raising rents for tenants by up to 10,000 per cent, The Mail on Sunday can reveal.

In the wider leasehold world, a 99-year lease would need extending quite quickly, and would be a statutory right. The National Trust has exemptions from leasehold law – quite rightly, otherwise these assets might be enfranchised and lost to the Trust – but has issued “voluntary extensions” to leases.

Some leaseholders are concerned that these voluntary extensions may not now be available, especially to National Trust leaseholders who have publicly complained about these issues.

In short, that they will be victimised by one of the most fondly regarded institutions in the country.

LKP asks for clarity on the Trust’s policy regarding voluntary lease extensions. However, we accept that they are entirely discretionary and the National Trust can choose to end the tenancy by not granting an extension.

The National Trust told The Times:

“We are aware that some leaseholders feel they have been misled as to the impact of modern ground rent and we take those concerns very seriously. If we are satisfied that has happened we will consider forgoing modern ground rent altogether, which we have already done in one case.”

The National Trust is invited to comment further to LKP.

The National Trust explains its “free” lease extensions in paragraph 2 below in a now deleted web page:

Now four in five homebuyers avoid new-builds … after ground rent scandals and shoddy build quality, that’s no surprise

Now four in five homebuyers avoid new-builds … after ground rent scandals and shoddy build quality, that’s no surprise

Disgusting

Ditto

Yup.

Suggest any NT members within our ranks to resign – and tell them why.

MR David Jenkins,

Reliance on the integrity, strength, stability,surety of a person or thing, or confidence..

Such is the definition of the word “Trust”

If you do go ahead with your scheme to increase ground rents, may I suggest that you drop the word “Trust” from the organisation as it would mislead the public?

Where does one start? Is David Jenkins any relation of Roger Southam? Whatever, he is cut from the same cloth. I no more know Jenkins than I do Southam but my instincts have served me well for close on seventy years, I am not an admirer of either – that is putting it mildly.

I have a particular loathing for worthy institutions, which are not worthy at all, like the NT, and even more so when they spruce themselves up and become modern, with all that that means (modern ground rents indeed).. Talking of things that are worthy without being so, charities and the Charity Commission, It seems the Commission intervened and managed to get the NT to want only an arm and two legs rather than the whole body from leaseholders in exchange for an extended lease, with ground rents in the thousands each year. Give yourself a pat on the back, Charity Commission, nobody else is going to. And whilst you are at it, is your back at all itchy? I am sure you know someone who will scratch it.

Sick to death of the whole leasehold business, the individuals involved in it and their machinations, and our supine government and its consultation which will result in tinkering, and not the RIGHTFUL ABOLITION of leasehold.

I think there needs to be a distinction drawn between those lessees who were originally granted the lease and those who bought the property with a second hand lease

Those lessees who bought the lease second hand and presumably paid a modest amount for the lease with say 12 yrs can hardly complain that the trust wants a modern ground rent or a premium when the lease runs out. Otherwise the lessee stands to do very well at the expense of the members of the trust

Those original lessees who have seen their lease run out may indeed have spent many thousands improving the property but the price they paid all those years ago reflected the need for the work to be done

I would have thought the original lessees should be allowed to live at the property paying just a normal rent rather than a modern ground rent.

Stephen – More patronising legal gobbledygook making fine distinctions between different classes of lessee and types of ground rent. Does anyone understand all this complex rubbish. It’s people’s HOMES that matter, not artificial financial instruments tied up in legal red tape. If Javid and Theresa May have principles they will abolish leasehold..

The National Trust has shown it has no charity. Disgusting behaviour to its tenants.

Hey Joe, everyone is entitled to their opinion…… However, I reckon The Rt Hon Sajid Javid will be taking note of the disgruntled leaseholders opinions relating to these injustices., I’m sure he wants to get re- elected!! Incidentally, didn’t Thin Lizzie record a fab record entitled ‘ Hey Joe’ ?

Cont… I loved that song.

Oops, of course you all know I meant ‘Hendrix’. Great song!!

The National Trust had some dilipated properties and offered 49 year leases at a ground rent and invited offers on the basis that the lessee carried out the necessary improvements

The term has come to an end and they are made to look evil for wanting a return based on the current value of the property which is now theirs following the expiry of the lease

I find it difficult to see why that contract was not fair and why the National Trust are being viewed as unreasonable.

Obviously if the terms of the lease were shrouded in legalise or they were told to use a certain form of solicitors that might change things. But the fundamental principal that if terms are clearly set out so that the lessee can clearly make their offer based on the facts before them – then both sides should be able to have confidence that the contract can be relied upon

Of late the explosion im house prices and the collapse in interest rates have caused lease extentsion premiums to rise and demands for a call to arms is made to attack the freeholder. What is forgotten in all the sabre rattling is that lessees have seen their mortgage payments fall and the value of their flats rise

If a lease runs out and this causes inconvience with the greatest respect it is the lessees who is to blame – in the case of the National Trust leases it was a deal where it was clear from day 1 the lease was for 49 years.

Sorry again, the theory sounds grand but the reality is different.

Values have not risen round these parts. The land registry shows that average sales for flats fell with the rest of the country after the crash, and only this year have returned to 2008 sale prices. Meanwhile, RPI continued to go one way. Our local values have not recovered and are on average 30-40% down on 2008. One flat bought an extension and sold for less than two identical “comparables” within a year… that is. comparable except that the two that sold for more had not extended their lease.

The whole leasehold caper is like ‘theology”. Nothing fits with reality but it is nevertheless true. Must be because the industry says so as do the tribunal courts.

It is a shame more folk do not read the Upper tribunal cases on lease extensions. Talk about theology. These are the only cases we get to know about.

I find nothing at all acceptable about ‘selling’ a dilapidated property as a 49 year lease and letting the buyers spend their own cash to do the gaff up only to have to hand it back.

People would not buy this stuff if the government put more health warnings on them.

They stopped people smoking quicker than they’ll stop them throwing their money away on leases. Too many legislators stand to lose.

Wondering what Lease plan to advise in their webinar to help us all make ‘informed decisions’ for the current consultation? Leasehold is just fine?

Stephen, either you have a vested interest in leasehold or you are a student tasked by your tutor to make a case for freeholders. Allow me to address your proposition that it is reasonable for the NT to benefit from improvements made by lessees to dilapidated properties. Quite simply they have no right to benefit from the work and expense of others, I need say no more.. Further it seems that the NT gave every impression when original leases came into force, and later, that extensions would be free with the clear impression that ground rents would be similar – no exploitation..

Impossible to live in this world if there aren’t the elements of trust, good faith, and fair play as bywords These eternal and wholly positive human qualities are fast being eroded by professional shysters. I mention no names in this regard.

Declare yourself, have you some interest in leasehold?

I agree with Paddy. In tha North East extending the lease on a flat is no guarantee that when you sell up you can command a higher price than a flat with a short lease. If the surrounding properties with little time left on the lease are sold cheaply, why would someone buy a flat a couple of doors away for more money. Most people including many estate agents don’t realise that a longer lease should add value to the property. I regret extending the lease on my flat, I wish I had invested the money on a freehold property. Yes it might make a big difference in London and the South East where property is at a premium, but not in many other parts of the country. As for Stephen , yes it might be legally ok for the National Trust to make people’s lives a misery by charging modern rents, but it is morally disgusting.

I do know of someone who bought 4 years ago a National Trust Property with a 14 year lease for a fraction of the normal price because the lease could. mot automatically be extended

Should he get a 90 yr extentsion for free making him a very substantial profit at the expense of the members ? I think not, he drive a hard bargain because of the issues with the lease. He fully accepted that when the lease ran out he would become a teen at if the trust.

Almost all National Trust properties are in desirable areas and are very very unlikely to be redeveloped

Therefore the tenant on a yearly/monthly rental has more or less security of tenure

All of which is missing from the article

Again I make the point that ground rents should be discounted at a prescribed rate and shown clearly when the leases is granted. When a leasehold property is sold I see no reason why the Discounted value of the rent is its NPV should not be calculated and shown in the contract of sale – again making the matter transparent

All the issues surrounding 10 year doublers would never have arisen if the discounted value was clearly shown along with the premium for the lease

Because the discounted value of the rent iwould be shown alongside the premium paid most new ground rents go forward would be relatively modest

However if I was selling a £300k flat I might want an annuity so if I offered it for £1 with a ground rent of £10k per annum I am sure for some this would be acceptable

firstly it would not be onerous as the terms are made crystal clear on sale

It would be somewhat hauling if 15 years later the purchaser or successor in title starting complaining that the terms were onerous unfair and should be cancelled

I would feel aggrieved as a deal was offered making it clear what o wanted setting out clearly that the NPV of the ground rent was worth £300k and if accepted the terms should be capable of being relied upon by Both parties

Stephen, You haven’t responded to my question in above post, have you an interest in leasehold, even if it is a professional interest?

In answer to your question, I am involved in the area of taxation but in my early professional life was involved in work on the Consumer Credit Act and in many ways there is a similarity with the current problem with ground rents.

The issue surrounding ground rents to day is that they have increased towards what they were in real terms at the beginning of the twentieth century. Typically a ground rent on a terraced house in the north was around a weeks earnings. The income reserved needs to be valued and shown as part of the consideration payable. If this had been the case none of the 10 year doublers would have got through as the NPV (Net Present Vlaue) of the rent would be such a large figure.

Logically a property subject to a ground rent will sell for less that an identical property with a peppercorn rent. Therefore the purchaser pays less but pays in effect interest on that saving. If it were called a loan it would be subject to the Consumer Credit Act and the APR would need to be shown along with other terms and conditions. Ground rents fall outside the Act and no details whatsoever need to be disclosed, which is why I feel todays problems have arisen

Again I repeat that the NPV of the rent using a prescribed discount rate should be shown on the front of the lease in the part called prescribed clauses and in particular in Box LR7. It is very simple step to introduce.

In reality developers, if my proposal was implemented, would probably move back to having relatively modest ground rents because they would need to ensure that the total consideration i.e. the premium and the rent did not seem excessive. However there will be cases where buyers will want to pay less for the property but in return pay a higher rent (this of course happens in commercial property) so the abolition of leasehold would restrict that choice. Abolishing would also create a second-class type of tenure, which may affect prices of existing properties

The abuse over administration charges can of course be dealt with by legislation and a more controlling ombudsman service.

Hello Stephen, thanks for the response. I am sure you know your technical taxation stuff but a communicator you are not, I had problems in understanding all of that.. You miss the point altogether anyway, this is a moral issue and even when you make a case for leasehold – some people wishing to pay a lower buying price and a ground rent – it is somewhat flaky.

I find it difficult to understand your angle, why you defend leasehold, and why you defended the NT in your previous posts. Are you simply a contrarian?

Leasehold should be abolished and with a retrospective element. It should be replaced with freehold and a form of common hold (there are instances were freehold/common hold are not appropriate but these are few). Further, no commercial organisations should hold an interest in common holds. It really is as simple as that. Leasehold is morally criminal and wrong and abusive. There is something wrong with your moral compass if you do not accept this.

By the way, a fundamental problem with the structures (law,parliament etc) in this country (and almost certainly all countries) is all of them are, above all things, firstly self serving, and also incestuous – that goes for the professions as well. Powerful businesses are a part of this circle of self serving self interest. Things are weighted heavily against the average Joe. Ombudsman services, absolutely no comment.

The theory that you pay less for a leasehold property than a freehold one is for me pie in the sky.. Once I have factored in the £10000 to extend the lease on my very modest flat I can categorically say that overall I am worse off than if I had just bought a freehold property in the first place.. Stephen, you are obviously a very clever man and have bamboozled us with your facts and figures, but surely if the system is so complicated to understand by the average man in the street then it is not fit for purpose. Leasehold should be abolished as it has been in the rest of the world, end of story.

I like to think that I am a “very clever” female and I certainly have not been “bamboozled” by any other contributors post….

When all the smoke, mirrors and yes, boondoggle disappears what one sees Is spivs and a trough.

I believe that leasehold will be abolished but alas not immediately. I suspect and hope that The Rt Hon Sajid Javid will legislate to Regulate Managing Agents and remove Forfeiture from the statute book bringing in measures recommended by the Law Commission in 2006. We’ll see!

Ground rent is not the only difference between a leasehold and a freehold property. Consider a situation where the leaseholders have acquired the right to manage but are subsequently faced with a tenant whose behaviour is in breach of the lease. The duty of enforcement falls on the landlord but he has no economic incentive to take any action.

The landlord still stands potentially able to make a windfall gain from forfeiture. He may make alterations to the building that are unwanted and not in the tenants best interests. He may continue to charge fees for reviewing alterations to flats.. etc.

RTM is taking the landlord’s hand out of your pocket. Acquiring the freehold is getting him out of your property altogether.