It’s a question worth asking, as its current owners venture capitalists Electra and Chamonix will get shot of it at the propitious moment.

It’s a question worth asking, as its current owners venture capitalists Electra and Chamonix will get shot of it at the propitious moment.

In February 2012 they bought Peverel, which had been part of the Tchenguiz empire from 2007 until it went into administration in March 2011. The deal involved a £62 million transaction supported with further working capital via a NatWest Bank loan.

In recent months, Peverel has appointed a £90,000 a year press guru, although a lot of the company’s efforts concern staying out of the public eye.

Recent LVT cases have been kicked into the long grass by arriving at settlements, where the parties sign confidentiality agreements. A recent example concerned Kingsborough commissions at a retirement site near Kingston, in Surrey.

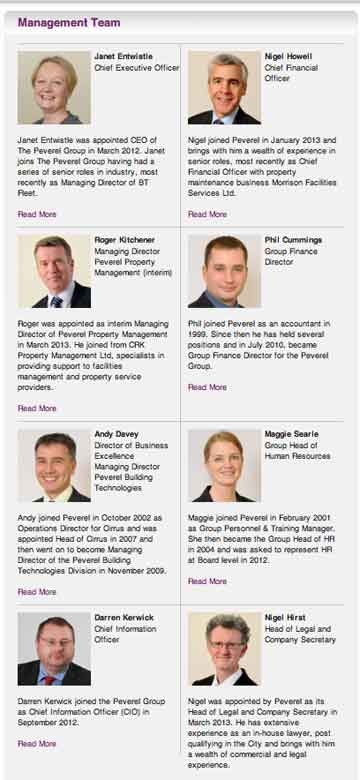

Janet Entwistle, the CEO, has made it clear that LVT cases must be headed off, and she is a strong supporter of confidential Ombudsman schemes.

Then there is the fact that key figures of the past have been shown the door, such as Lee Middleburgh, the former head of residential, and Keith Edgar, the ex-head of Peverel Retirement. Former head of legal David Edwards has joined the Anchor Trust.

Most intriguing is Peverel’s relationship with the only customer who really counts: the Tchenguiz Family Trust. It owns the bulk of the freeholds that Peverel manages (including those of 53,000 retirement flats).

These freeholds have been up for sale for a year or so, and is an open question what Peverel’s relationship would be with a new owner.

It is odd that at a number of important sites – Palgrave Gardens, near Regent’s Park, and the massive 422-unti Metro Central Heights Metro Central Heights at the Elephant and Castle – Peverel has not resisted right to manage. Instead, it has co-operated with the process in exchange for a one-year management contract.

Why?

The Right To Manage Federation, which handled the RTM at Metro Central Heights, has contacted LKP to point out that it was actually the RTM Company that chose to continue with Peverel on an interim basis. It did not think the acquisition date gave sufficient time to select a new agent.

Of course, ownership of Peverel has been a game of pass-the-parcel from the early days. It was originally a Bournemouth estate agent that got lucky tying up with John McCarthy, the founder of retirement leasehold pioneer McCarthy and Stone.

At some point in the eighties it was absorbed into the housebuilder only to be sold again in 1993 after the first retirement leasehold mutiny. This is when John McCarthy sued the Daily Telegraph for £800,000, but abandoned the case after blowing £200,000 on lawyers.

Peverel was then sold off to Electra in 1993 for £30 million.

John McCathy recalls in his autobiography Building a Billion:

“Interesting, in the formative days of us moving into the provision of sheltered housing in the private sector, a number of institutions including Housing Associations were not interested in taking on the management. They seem to have missed out.”

A management buyout followed and in 2007 Peverel ended up in the hands of Tchenguiz.

It has now lost the management of the pick of its prime London sites, and none of the prestige housebuilders will touch it. Nor will McCarthy and Stone, curiously, which is now attempting to manage its properties – the very few it has built since 2008 – itself.

Stuff a leaseholder and win an iPad! The unpromising debut of ARMA-Q

Stuff a leaseholder and win an iPad! The unpromising debut of ARMA-Q

What to other companies may just appear to be a coincidence, in the case of Peverel, there is normally a reason behind every Peverel Action( just to mention another site who mentioned the possible sale of Peverel!)

We have a situation in which Peverel are almost exclusively dependent on the Tchenguiz Family Trust as their customer base. Though Janet Entwistle often refers to leaseholders as “customers” this is rather akin to a shark referring to the turtle he is lunching on as a customer!

What is clear is the inter dependence that the freeholding and managing companies had, and how vital to both companies survival keeping connected was.

Initially it was thought that the Tchenguiz Family Trust could buy Peverel out of administration.

When this did not prove possible the next idea was to sell to a private equity company and then the Tchenguiz Family Trust could buy it.

As we know this did not happen either. This left Peverel adrift and more importantly the Tchenguiz Family Trust lost the income they needed to support their interest payments.

It is proving very difficult to sell the property portfolio, in part because of lack of liquidity in the market, in part because the scheme thought up by Tchenguiz that “could not go wrong” did go wrong(very badly wrong!) and in part because of gross over valuations and finally the reputation of the Tchenguiz Family Trust.

Purely speculation on my part, but given the problems selling the freeholding companies, i would not be surprised if Bill Proctor was not working on some weird and wonderful plan to finance the purchase of the freeholds. Certainly, i shall be keeping a very sharp eye on him.

It is to my mind very significant, that Peverel are trying to get as much cash in as possible in the short term, indicated by trying to appoint a “County Court Administrator.”

It is also of note that Peverel are very keen to avoid LVT’s or RTM’s. They want to keep things very quiet at present and in exchange for confidentiality will refund excess insurance premiums, but express those refunds in unusual ways(perhaps reducing Careline fees?)

Peverel are doing all they can to “Buy Time”

Well said. If any of their developments would like a little free help on how to do a RTM or enfranchisement, I would be more than happy to point them in the right direction. It is time for these Leaseholders to start fighting back.

If these companies have the audacity to think they can case win over leaseholders over by giving them a ‘refund’ on excess insurances that owners have probably been overpaying for years then that just shows their barefaced arrogance.

Leaseholders, please do not sell your soul and sign any confidentiality agreements, you just need to do an RTM … Start now!

It has recently been brought to my attention that the attempted sale of the Tchenguiz property portfolio,actually began around 2 years before it is commonly thought.

It would appear that the process was started after administrators for Kaupthing placed Tchenguiz loans in default, which triggered senior debt defaults. It is believed that Vincent Tchenguiz pledged shares in the first tranche of loans to support his brother Robert and subsequently took loans to service other loans. Following a “confidential agreement” following the Kaupthing bank collapse, (i cannot say with any certainty which side came out best) i understand that at this point moves were made to sell the property portfolio. I have been led to believe this was before not after the SFO raid.

It also appears to coincide with the period that Estates and Management and Peverel were at their most voracious in finding ways to extract money from leaseholders.