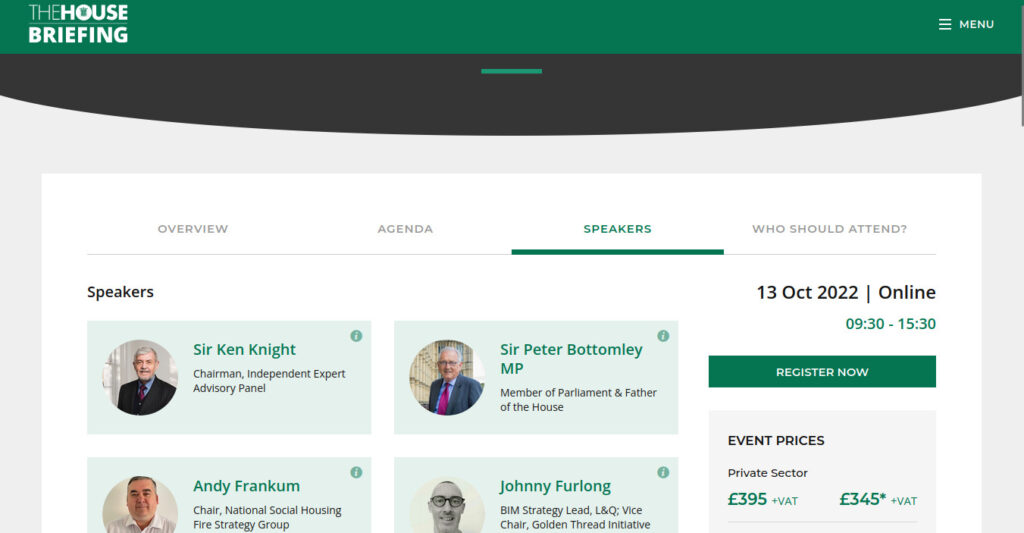

This is a speech given by Sebastian O’Kelly, right, of the Leasehold Knowledge Partnership, earlier today at an event chaired by Sir Ken Knight

From the outset I think I should declare that I am not leaseholder nor am I personally involved in the building safety disaster. Nor do I stand to be remunerated by it, either directly or indirectly.

There are many leaseholder speakers who are personally involved in this – and have lived with the anxiety of safety concerns and wipe-out remediation bills – and they have risen in prominence in both Parliament and the media over the past two years as this festering problem keeps grinding on.

LKP is very pleased to have fostered the foundation of these cladding groups, offered the first forum to impacted leaseholders at Westminster in the autumn of 2017 and delighted by the effective message they regularly deliver in the public arena.

We are also, still, routinely contacted by affected leaseholders through our website Help Form, and try to untangle the mysterious workings of the Building Safety Fund.

The message is always a version of: government seems to have finally got this – the background music is good – but for final resolution which will allow thousands to get on with their lives it is going to take – yet more – time.

Meanwhile, we remain deeply concerned by the self-interested lobbying of freehold owning entities and the terracotta army of leasehold professionals – property managers, structural engineers, fire safety consultants, insurers etc ad nauseam – of whom it might be said that it is an ill wind that blows nobody any good.

We strongly deprecate government’s consultative methodology of speaking to various interested groups in isolation and then drawing their own conclusions of where to head on. With trade groups and freeholders now deploying professional lobbyists – depressingly including former officials – to argue their case with civil servants and ministers there is always the danger of policy heading down a path comfortable to vested interests not the victim consumers.

We urge a roundtable meeting of all stakeholders to argue the assorted issues that emerge from the building safety crisis in open and transparent dialogue.

Given that the whole housing market is now skewed by the building safety crisis – sales of flats are less that 50% of what they were in 2019 – and, according to several analysts, the cladding crisis is now impacting new housing supply – with the recent tanking of housing builder shares last week – this issue is surely a matter for open debate, not shadey lobbying which has so unfailingly failed in the past.

After mentioning leaseholders who speak out about these issues, I want to single out Sophie Bichener, 30, a marketing manager who bought a flat at the 16-storey Vista Tower in Stevenage, in June 2017 – just before the Grenfell tragedy.

In fact, there is no reason to highlight Ms Bichener over, say, Abi, who delayed plans for having a baby, or Hayley, who went bankrupt 18 months ago, or Dr Will Martin, who carried out an exhaustive survey of mental health effects of cladding while at the same time keeping going as a junior doctor. As my own daughter is a junior doctor in our impossibly over stretched NHS, I know what an achievement that was, from someone who is actually contributing something worthwhile to society.

Vista Tower is notable because it has the highest building safety bill in the country with each flat looking at a cost of £208,000 per flat to remove combustible expended polystyrene insulation and fix faulty fire barriers.

Ms Bichener only paid £230,000 for her flat.

Government is now taking legal action against the freeholder, Grey GR Partnership Limited which is part of the £37 billion railway pension fund Railpen.

Government is sounding threatening, with the new Communities Secretary saying – as did Michael Gove; as did Theresa May – that “Enough is enough.” Leaseholders should not be paying anything to remediate problems that were not of their making.

But what happens if Railpen calls government’s bluff and the matter heads into the black hole of the courts?

Surely, Railpen is – as freeholder lobbyists have frequently argued – as much of a victim as the leaseholders: it bought the freehold for its long-term income streams and has discovered, as have the leaseholders, that it was shoddily built, with the developer long gone.

“For the past three years all I’ve thought about is how to pay this bill,” says Ms Birchener. “How it will impact the rest of my life. I have been thinking about how I will go bankrupt – how I won’t be able to get a car, get another place, get married, have children.”

Cladding bill prisoners could finally be released

For the past three years, Sophie Bichener, 30, has been living with what she describes as a “noose around my neck”. The marketing manager moved into her first home in Hertfordshire shortly before the Grenfell Tower fire in June 2017, only to discover after the tragedy that her apartment block, too, was covered in highly flammable materials.

23 other buildings registered with the Building Safety Fund have also been unable to progress because of “unnecessary” delays, and legal action is being pondered by government.

Simon Clarke says: “This legal action should act as a warning to the rest of the industry’s outliers – big and small. Step up, follow your peers and make safe the buildings you own or legal action will be taken against you.”

But others might ask: will this break the impasse or be the start of a wrangle that extends for years more?

Looking at this from the outside, it is notable that five years after Grenfell nobody has had the courage to say: “we were in part responsible for all this”.

As soon as the Hackitt project began – with no consideration at all to leasehold tenure – all the professional groups that oversaw the system that allowed Grenfell to happen became part of the best practice groups chorusing that something had to change. Perhaps what had to change was them.

Let’s look at the creation of the role of the “building safety manager.

Until this was stopped, this new role took up five whole sections of the Building Safety Bill.

We had dozens of people seeing this as the next gravy train with the BSI persuaded to produce a new standard even though those pushing the proposal accept that not a single person had the relevant skills.

During the occupation phase of a block safety is something all staff should be thinking about, not something left to a new highly paid executive looking to find yet more ways to spend other people’s money with absolutely no accountability for their actions.

Yet … LKP has never claimed to have any particular expertise in the area of fire safety: plenty of others, many here, have that. It will be for others to decide how it was that we built blocks of flats so badly, that standards fell badly, that regulations were watered down to a minimum, that cladding manufacturers cheated the system to sell their product.

We await the fallout of the Grenfell report.

Our role is reform leasehold and to remove the irrelevant third party freehold investor, who sweats his assets for profit and hitches a ride on the homes of other people.

Almost immediately after the Grenfell tragedy took place, we asked: can the leasehold system survive the sort of scrutiny that is going to result?

By 2017 LKP – founded in 2012 – had finally broken through to mainstream media as a result of exposing the doubling ground rent scandal, which is still occupying the attention of the Competition and Markets Authority forcing housebuilders to pay to remove these predatory income streams even where they have sold on the freehold; even where housebuilders own cynical initiative to vary doubling ground rents to rise with RPI instead.

But the building safety disaster that unfolded after Grendfell dwarfed this scandal.

Not only was our housebuilding sector cheating its customers with ground rents, paying its CEO executives outrageous princely bonuses, it was building fire traps for the residents as well.

Ministers seemed all at sea. They helped set off a panic of building safety that seemed to suggest that every block of flats, even non high rise, needed millions spent on them and then told housebuilders and freehold investors to “do the decent thing and pay up”.

We pay tribute for Barratt doing so at Citiscape, built 20 years ago in Croydon, subsequently discovering that it was so badly flawed that the block had to be evacuated and rebuilt.

Others didn’t do anything of the kind.

Let’s recall Lendlease taking its Manchester leaseholders to court to establish that they would have to pay for the building remediation – and promptly won a £160 million tender to tosh up Manchester City Hall, prompting furious outrage.

Ground rent speculators Pemberstone seek £3m tribunal ruling over Grenfell cladding

Galliard, after much arm twisting, sorted out New Capital Quay in Greenwich.

Then there were the freeholders – some of whom, even in 2017, were racking up hundreds of thousands of pounds for tokenistic waking watch patrols at blocks of flats – paid for by the leaseholders to cover their own compliance backsides, sometimes by loans into the service charge.

The call by ministers for the sector to “do the decent thing” was a complete failure to understand the nature of leasehold, and basically wasted two years.

We even agreed that freeholders faced impossible bills.

At Northpoint in Bromley, Vincent Tchneguiz could hardly shell out £4 million in remediation costs at a site where the ground rent is only £7,000 a year.

Unfortunately for him, there is also a right to manage company, so he not even making an insurance commission, either. So, its ground rent, sublet fees at £120 a pop, charging fees like £80 to keep a cat and development potential. That’s it.

Let’s look at Sophie Birchener’s Vistry House: Railpen – and it is rare in recent years for pension funds to be able to afford ground rents: offshore private equity accounts for most of them – is probably getting between £22,000 to 25,000 in ground rent. But the remediation bill is £14.9 million.

Our stomach turns a little when freeholders say “we are the victims, too” of the building safety crisis. But the truth is the scandal has emphasized their essential pointlessness:

a parasitical role, with huge legal enforceable rights as landlord, that has no equal in any other jurisdiction.

The obvious conclusion to policy makers is surely this:

IF THEY CANNOT AFFORD TO PAY TO REMEDIATE THEIR BUILDINGS, THEY SHOULD LOSE THE FREEHOLDS.

Finally things changed with government when the then Housing Secretary James Brokenshire raided his housing budget of £200 million in May 2019: the first of several undertakings that government was going to help pay up which now accounts for the Buising Safety Fund having £4.5 billion.

In December 2020 LKP argued that the building safety crisis was a failure by housebuilders, cladding manufacturers, insurers, lenders, and freeholders – the whole lot of them who make money out of leasehold – and they should pay a levy to put things right.

Housebuilders alone had made £10 billion in profits since the Grenfell fire.

The proposal was given detail and authority by Dean Buckner, a former Bank of England economist an LKP trustee and his team.

A version of this levy is now government policy thanks to Michael Gove and Lord (Stephen) Greenhalgh as minister for the cladding crisis: the first two ministers to really understand the building safety crisis.

The anger of leaseholders caught up in these failings – and that of the wider taxpayers now also paying for it – is unlikely to abate.

I suspect it is likely to intensify, if Railpen and other freeholders decide to fight.

The British courts are very accommodating to property rights, of course.

But there are limits.

If freeholders do not pay up for the failings in these buildings, what on earth is the point of them?

They argue that they are “responsible long term custodians”; they provide professional management.

But they are invariably offshore and anonymous, yet making decisions on people’s lives and homes.

Others here will talk informedly about the technical and legal issues of the building safety crisis.

But I think that we have still called this right: we questioned whether leasehold would survive the scrutiny that would result after the Grenfell tragedy.

The Leasehold Reform (Ground Rents) Act that came into force on June 30 2022 ends future ground rents.

There are a raft of further leasehold reforms outlined by the Law Commission and further refined by enthusiastic and informed officials.

One consequence of the Grenfell tragedy, that cannot be over-emphasised, is that the housebuilders grip on the government’s mindset is broken.

The ordinary homebuyer, the consumer, is now being listened to as never before.

Rendall & Rittner makes nearly £1 million a year in gas and electricity commissions

Rendall & Rittner makes nearly £1 million a year in gas and electricity commissions

The “Freeholders have had it all their own way for too long” They should be made legally responsible for their own properties, and not the Leaseholder or others. Some of them choose to purchase “shoddily” built properties, so do not expect others to foot the bill. It is your asset, so you put any faults or defects right out of your own pocket.

The custodian argument that they put forward is a non-sense, they purchased the Freehold and must take responsibility for that asset in full. They trouser the income without hesitation and expect Leaseholders to cough up for a variety of faults and defects that had nothing to do with them.

Any purchase involves some risk, so has an example, if you buy a used car and it breaks down (not under warranty) then the owner picks up the tab, not your passenger, Government or anyone else. So why should Freeholders expect to be treated differently?

Mr O’Kelly’s article is comprehensive and very informative, and I urge all Leaseholers to make your voice heard, do not suffer in silence, contact LKP, your MP, Newspaper and post your comments on this forum.

An interesting article, Sebastian. What is your view of Resident Freehold Companies who now own their building and find it has compartmentation issues or cladding defects? They are not “offshore and anonymous”. Nor do they “trouser the income”. How wicked are they in your world?

When you own the asset you take resonsibility for it, as a free holder. So the same applies for offshore freeholders buying into trousering income from leaseholders or indeed, Tofu eating Resident Freehold Companies.

This is a free market economy (unless your an energy supplier or railway operator/track repairer) and asset management has it risks. When a person buy a freehold house and discovers its 50`s built garage is an asbestos trap, they pay for the removal and replacement materials and labour. Not some govt fund; the taxpayer. So if youre freeholder its your asset. Tough Luck.

Why should the tax payer fund any of this remediation.

Dear Mr. Wales,

“What is your view of” Managing Agents / Freeholders allowing their utility suppliers to charge the incorrect rate of VAT on communal electric and water bills, and then rebilling Leaseholders for that amount? How can Industry leading Company’s make such a simple error of judgement?

Another quite astonishing consequence of achieving Right to Manage, has materialised in the fact that our communal water bill has halved since we achieved RTM status, we continue to be truly baffled that simply by going RTM costs can simply halve overnight, (Occupancy rates remain the same Year on Year!)

About 80% of all cost headers on the inherited service charge from the former MA, have been proven to be less than competitive. This has resulted in a significant cost reduction to the Residents of our apartment block, without in any way affecting the upkeep of our home

So, in a nutshell, achieving Right to Manage has resulted in a – 23% reduction in service charge so far. It is anticipated that by 31.03.23, we anticipate that reduction to meet or exceed – 40%.

If we can achieve this outcome, why can’t the Professional Freeholders and their Managing Agents achieve the same or better?

Dear Professional Freeholder,

I await your reply, why did you not achieve the same or better in terms of the above, at my Residence when you controlled your appointed Managing Agent ?

I consider myself to be nothing more than a Amatuer in terms of property management, we have achieved more in seven Months has a RTM Company than you have in the past several Years.

Facts speak for them selves. Go Right to Manage, why employ an imposed MA when there is every likelihood you could do a better job yourself by employing a Managing Agent of your Choice!

I believe that RTM will and has benefited the Leaseholders of All Developments regardless of size.

Laws preventing this Can be changed or annulled.

I live in a resident owned building though not all of us bought into the freehold. I chose not to and so am now under the control of my neighbour freeholders. I still have no say in anything and the Directors and Managing Agent rule with a pretty heavy hand. They still charge annual ground rent and I am now disqualified from the government cap due to the fact that some of the owners are now freeholders (by forced acquisition from the developer). It’s an absolute lose lose for me.

Resident owned buildings are in the most difficult position. The government call for evidence should show them why something needs to change. Your RMC still has to follow the s20 procurement rules and you have your rights under s27A of the 1985 Act and all the other legal protections provided to leaseholders but do not have a vote in the RMC.

Spot on Amanda! The situation for leaseholders, where some owners have bought the freehold but many have not , has been seriously overlooked. The government has said that NO leaseholders will pay, or ,at least, will be’ capped’ but ‘enfranchisement’ where only some owners have purchased the freehold leaves the remaining leaseholders in peril. There are many many very anxious people out there who have bought apartments that now seem worthless. This must be addressed and immediately. A concerned onlooker.

Highbury Stadium Square – Right to Manage

It has just been reported that “Highbury Stadium Square” have achieved “Right to Manage” status, I understand that Highbury Stadium consists of about seven hundred and fifty apartments, and recently employed firstport has the managing agent.

I congratulate all the Shareholders / Residents at that apartment block for achieving RTM, you can now look forward to a reduced future service charge, and value for money in terms of the supply of goods and services, allegedly.

I hope that others take note of this recent development and follow the shining example of “Highbury Stadium Square” and go Right to Manage. Freeholders take note! Leaseholders have had enough, and have, and will continue to exercise their Legal right to go Right to Manage.

RTM is a joke or at least the process is. If you live in a small block with most of the flats owned by disinterested slum BTL landlords you have no chance of RTM.

It will be interesting to see what will happen with soaring costs of living and sky high taxes for the next decade. I can see a large percentage of leaseholders no longer being able to afford service charges.

And if course that will put more burden on the existing leaseholders when the others default creating even more leaseholders defaulting.