Back in 2006 the Law Commission recommended the total removal of leasehold forfeiture, but the government and its officials have done nothing about it.

Instead, they argue that it is a very minor issue.

So minor, in fact, that last year when the then shadow communities secretary Emma Reynolds asked in a parliamentary question how many cases of forfeiture were granted she was told by MoJ that it would be a waste of resources to find out.

Fortunately, the volunteer resources of LKP have been slightly less ineffectual than the civil service: there were 125 residential leasehold forfeiture cases heard in tribunals in England last year.

Almost half these cases were heard in the London tribunals.

The new housing minister Gavin Barwell, the Conservative MP for Croydon Central, may be curious to know that he represents an area that has averaged two forfeiture cases a year since he was first elected in 2010.

Forfeiture does not work like mortgage repossession. With forfeiture you lose everything.

If you owe more than £350 the lease on your flat can be lost. Completely, along with all capital and whatever mortgage loan there was on it.

Nasrin Qureshi, an investor from the Middle East, lost her £165,000 flat, bought with cash, in April 2013 because she did not pay ground rent and service charges amounting to £3,140

Every professional in the sector will claim that lease forfeiture is rare. Absolutely no one attempts to justify the cash windfall a freeholder can obtain from forfeiture.

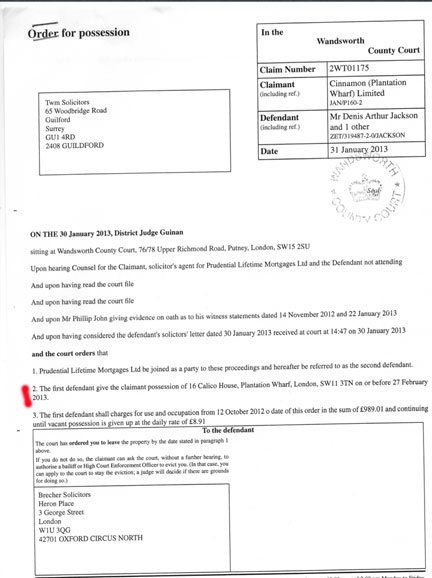

An example is the £800,000 flat in Battersea flat of pensioner Dennis Jackson, 73, that was forfeited in 2013 by the freeholder Cube Real Estate, owned by a US private equity outfit.

This was a service charge dispute over £7,000, which through outrageous legal gamesmanship had escalated to £80,000 in legal costs.

The forfeiture took ten minutes in front of a junior judge in Wandsworth County Court.

It required the determined efforts of Sir Peter Bottomley and LKP to get this overturned.

Astonishingly, the decision whether or not to render Mr Jackson destitute and homeless was taken in a closed court. Both Sebastian O’Kelly and Martin Boyd were thrown, principally because the former is a journalist.

The treatment of these two leaseholders over debts was far more draconian than the criminal court’s punishment of mortgage fraudster Mr Waya, whose seed capital in leasehold property was scrupulously returned to him.

Leaseholders do not need any reminding that lease forfeiture is the nuclear weapon in the freeholder’s armoury and it is threatened absolutely routinely in any money dispute.

This is an example from the freeholders’ debt-collecting solicitors called J.B Leitch:

Without prejudice to any action that my client may take concerning the breach of lease, my client will accept the following terms to remedy the breach:

1. You enter into a Deed of Variation with our client;

2. You pay consideration of £705.00;

3. There be an 50% increase of the current ground rent payable;

4. You pay an annual sub-letting fee of £100.00 plus VAT;

5. You pay LPM’s costs of £440.00 inclusive of VAT; and

6. You pay our client’s legal costs of £240.00 inclusive of VAT.

Should you fail to admit the breach, or the above terms are unacceptable to you, please note that my client will issue proceedings in the county court to seek a declaration that the lease is in breach as a pre-requisite to forfeiture proceedings being instigated in respect of your leasehold interest in the property.

Lawyers and officials may argue that leaseholders have rights, and that such a demand can be disputed in the courts. But those in-the-know know that the dice are stacked in just one direction.

There is a 99 per cent chance the lease will give only the freeholder the right to all his legal costs no matter what the result, and the courts will give a 99.9 per cent+ chance that the leaseholders will have no right to their costs even if they win.

One of Mr Barwell’s early tasks will be to sign off the privatisation of the Leasehold Advisory Service.

This is greatly to be welcomed.

One of the paid-for courses offered by this government quango, set up with taxpayers’ money to protect leaseholders, includes advising freeholders and managing agents about “Forfeiture of the lease”.

In effect, the quango has been selling training to freeholders on how to forfeit a lease, while simultaneously offering free initial advice to leaseholders how to avoid having their leases forfeited.

It is long overdue that the Leasehold Advisory Service takes its chances in the commercial world.

Tower Hamlets Homes spends thousands to thwart recognised tenants’ association

Tower Hamlets Homes spends thousands to thwart recognised tenants’ association

This is article is total rubbish – leaseholders can be granted relief from forfeiture for years after it has happened. If they took their responsibilities as seriously as they take their rights they would not get into that position in the first place.

If you remove forfeiture, you remove the ultimate sanction for people who refuse to abide by the lease – the very document that makes it possible for people to live relatively peacefully in communal buildings.

Hi Alison

I like your comment although I suspect I will be in a minority. I have previously posted about the difficulties in exercising forfeiture where the leaseholder is also a PRS landlord.

In my situation, adherence has been made to not only the managing agent in-house procedure for collecting service charges but also those of our company solicitor. This has resulted in a charge for outstanding arrears being placed on the property but since then, they have been accruing all over again.

I have therefore instructed our solicitors to start forfeiture proceedings but after their further consideration they have voiced a concern as the judgment in default previously obtained against the lessee is secured under a final charging order. They are concerned that should the lessee wish to oppose forfeiture of his lease, he may have a defense in that the sums for the outstanding arrears for certain periods are secured. Both enforcement options cannot be used at the same time.

So what are my options?

I could consider making a court application for an order for sale, but my understanding is that the court is unlikely to grant such an order as the outstanding arrears ( including those which have been accrued since the charging order) are in the region of £9,000 which may not be a sufficient sum considering the value of the property.

I can nevertheless instruct that a s146 notice on the lessee and his lender be served in the hope that the lender may be willing to make payment on the lessee’s behalf. If the lender does not wish to make payment, I could then suggest instructing counsel prior to starting forfeiture proceedings in light of having a charging order. Alternatively, I could again bring proceedings against the lessee for the new service charge arrears accrued since the charging order was made. Once judgment in default is obtained, I can then instruct the serving of another section 146 notice and start forfeiture proceedings.

I accept that the amount of arrears pale into insignificance against those of other leaseholders who have been at the mercy of large corporate landlords with the battery of legal support they can command. I also understand the subsequent calls for the abolition of this freehold right.

I am however placed at the other end of the spectrum as I work for the Directors of the RMC which owns our freehold. Quite frankly I am unconcerned about the potential loss of both the lease and therefore the property to the lessee should I be successful in applying forfeiture. He has flouted every legal requirement in the book, both as lessee but a landlord, culminating in his failure to even apply for a landlord license. Having been advised of the steps involved in the process, he could remain in illegal operation for many more months.

He has tried to sell the property more times than I care to remember but since the charging order was secured he has not pursued this avenue. He even went so far as to start the statutory lease extension process but failed to defend his position on the arrears at the FTT so now our solicitors can add their fees to the list as he did not pursue it any further.

And don’t get me started on waiver

Alison,

There are many people in government and the sector who misunderstand this issue. If you want to suggest the article rubbish, or even total rubbish I would have hoped you might have supported your claim with at least some factual evidence.

I would point out that as well as it being our view that forfeiture is wrong it is the view of the Law Commission, the Council of Mortgage Lenders, the Law Society and many others on both sides of the sector as well as being the view of many lawyers and politicians.

As you will have read the article is also more about the number of times that forfeiture is applied for in the Tribunals. This has been an issue the sector and government has pontificated on for years without data. The matter of potential relief you mention is a different matter covered in different articles..

If you were a leaseholder in a block where you owned a share of the freehold and have had to use the forfeiture rules to try and get payment.or force a fellow leaseholder to abide by the lease I would understand why you believe that forfeiture powers must be needed. They are after all currently the only powers you ultimately have. and can be difficult to apply.

However as a managing agent I would suggest you know full well forfeiture can often be a rather different and sometimes more dirty game..

The 2002 Commonhold and Leasehold Reform Act placed an additional step in the process through s168, requiring the landlord to prove the breach prior to moving to a final application for forfeiture. But once the s168 hurdle has been met forfeiture can arrive very quickly.

It is true as you say that ” leaseholders can be granted relief from forfeiture for years after it has happened” but only if the landlord has chosen not to act. As you will also know by allowing this delay the landlord can place themselves in difficulty.

If the landlord apples for forfeiture it can happen very quickly and if relief can not be obtained. the lease can be gone in a couple of months and the chance of retrospectively gaining relief are very very small.

You are also wrong to suggest leaseholders only arrive at this point through their own fault as there are more than one or two landlords and managing agents who do not always play cricket. Some landlords and some solicitors actively seek to use these draconian powers to advantage themselves or their client or both. Mr Jackson started by winning his Tribunal case for being overcharged before things ran out of control through a series of mistakes by the courts and the Tribunal and other issues.

By the time the end of the legal case for forfeiture is reached a leaseholder may well be in a position to pay the original debt or remedy the breach but not afford the huge legal fees accumulated by the process.. This is part of the reason for the introduction of s131 of the Housing and Planning Bill giving the Tribunal and Courts desertion to place more limits on these legal costs.

You are also wrong in thinking that the removal of forfeiture takes away an obligation to follow the lease. If you read the work of the Law Commission from 2006 you’ll see .it proposes taking away forfeiture by moving to a forced sale system where the monies distributed fairly. Such a system takes away the benefit of the landlords windfall profit. It is also a system that works well in other countries

.

Alison,

Just suppose you have assets of 350,000 pounds and I claim that you owe me 500 pounds, and you refuse to or can’t pay?

I could take you to court and if successful could get bailiffs to seize 500 pounds of your assets.

Would it be fair if instead of taking just 500 pounds of assets, i could simply help myself to all of your assets? In effect that is what forfeiture of lease does?

Additionally, the threat of forfeiture frightens many people into not challenging actions of freeholders.

I would like to know of any instances where a breach of lease by a freeholder has resulted in the freehold being forfeited?

By way of example of how unfair forfeiture is look at a live case right now. The freeholder on a maisonette in south west London owns the upper floor flat which they have rented out over the years to various tenants.

The flat downstairs was bought by an ex-service man and his partner who intended to settle there but the chap got a Job working for a bank and got posted to Milan for two years. He decided to rent out his flat for the two-year period but noticed that his lease contained a clause that said:

“4. Not to use the premises hereby demised or permit the same to be used for any purpose whatsoever other than as a single private dwelling house in the occupation of the Lessee and his family.”

He tried to contact the freeholder to ask permission to rent out his flat for the two years but they did not answer him (allegedly the chap made more than 60 calls to them with no reply)

Eventually the managing agent replied saying they would not give permission to sublet and if he did the freeholder would go for forfeiture or the chap had to pay a big license fee to the freeholder for their permission.

The chap eventually offered 15k to the freeholder but the managing agent said he should consider “doubling it” (to rent out his own flat for two years!!!) The chap took legal advice and decided the clause restricting him renting out his own flat was unfair and so he rented it out.

The freeholder took him to the FtT but lost, they appealed to the Upper Tribunal and won. Now someone who owns a flat where the freeholder above rents their flat out full time is facing forfeiture because he rented his flat out once!

Immoral, should be illegal, unfair, unbalanced, disproportionate and pure evil. This happens all the time and it has to stop.

Another project where buying the freehold is in progress, the freeholder phoned up flat owners to say if you go ahead with trying to buy the freehold from us we will go for forfeiture on all your flats as you rent them out and there is a clause that says you can’t. They are using the threat of forfeiture as a way of bullying leaseholders out of a legal right they have. Immoral!

Come up with a system for serial non-payers but not losing their flat lock stock and barrel and giving it to predatory freeholders, there is no possible argument to say this is a fair exchange nor could it ever be.

The article has quite rightly highlighted the unfairness of current forfeiture legislation.. It is widely disproportionate.

For financial breaches of a lease, normal debt collection methods should be employed.

I question the right of a freeholder to approach a mortgage lender, as this means that the freeholder is breaking consumer debt guidelines by informing a third party of a debt. remember a debt is only a debt when it is either admitted to, or proved in court.

Worst ways., if a property is forfeit, then only the debs should be recovered, the remainder of the funds being passed to the leaseholder .

Legal fees should be proportionate to the debt, and should never exceed the amount of the initial debt, and crucially those fees should be excluded from any forfeit actions and be treated separately.

This would stop the contemptible exploitation of good people such as Denis Jackson.

For non financial reasons, such as a leaseholder making life intolerable for other residents (perhaps drug dealing, prostitution, running 24 hour rave parties or far worse by hanging an Arsenal scarf out of the window ) forfeiture must be an option, but the freeholder must not be in a position to make a financial gain from such action.

The use of the threat of forfeiture by unscrupulous freeholders as a weapon to extract undue and unwarranted sums from leaseholders in blocks of flats is not only an example of the blatant intimidation and harassment practices that abound., but also designed as part of a wider scheme to obtain Judgement by Default in the County Court.

The issue of letters threatening forfeiture unless such sums are paid forthwith can have catastrophic consequences for isolated, particularly elderly, leaseholders. In one such case a 93 year old lady died within 48 hours of receipt of such a threat, which was based on a grossly overcharged insurance premium demand the LVT had already determined unreasonable- and which with loaded add-on “fees” had been inflated to an astronomical sum. .

Notwithstanding action by leaseholders post event to Set Aside such Judgements, these false sums are then added to the annual Ground Rent demand, and carried forward year on year.. With rapid turnover in the sale of flats, the unscrupulous freeholder banks [literally] on the fact that the seller will in desperation finally pay up to get out.

This scam is a particular favourite of the unscrupulous few engaged in the purchase of Freehold Title Portfolios. Leaving aside the question of legality of some such transactions, freehold title purchases are often completed through loans obtained from financial institutions, and a portfolio of 1,000’s of properties [names + addresses} enables the unscrupulous freeholder to build up a paper “asset” value based on false demands made on leaseholders.

When should financial institutions examine more closely the “security” supporting such loans, it is my view they will discover in certain cases:

1. The Original Disposal [Freehold Purchase] was completed in criminal breach of Part 1 of the L:TA 1987 and,

2. The paper “asset” value the unscrupulous freeholder shows to support the loan [and further loans] is worthless..

Alison I agree and value your comments. It’s very unfortunate that hysteria is given to forfeiture and it is portrayed on this site as something done by the “greedy freeholders”. Let’s face the facts

1. Forfeiture cannot be obtained on service charge unless there is a prior determination by a Tribunal or court. After the determination the leaseholder still has plenty of time to settle the account . The leaseholder might dispute it but if it is determined as due by court or Tribunal them why is it unfair ? Only after the determination and after at least 28 days pass can a 146 notice be served and only then application to court to forfeit. Throughout this period the leaseholder has months to settle. A leaseholder who does not settle has only themselves to blame.

2. Forfeiture for ground rent is only above an amount of £350 or several years of arrears. Ground rent surely cannot be disputed and again the leaseholder has only themselves to blame.

3. As demonstrated in the judgement enclosed with this article even when courts grant forfeiture they still give another month to settle the account to avoid forfeiture.

4. A leaseholder with equity in a flat above his/ her mortgage would find that mortgage lenders tend to settle the bill to avoid forfeiture and will them seek to sell the flat and any balance paid to the leaseholder. There is therefore no chance that the freeholder would obtain the so called windfall.

It takes a leaseholder who sits months on their hands and ignores all the issues to get to forfeiture. Even when forfeiture is obtained it’s easy to get relief. So let’s stop the hype and pretend that leaseholders are losing flats due to forfeiture. It’s a rare occurrence and only happens to a leaseholder who has themselves to blame. Surely efforts should be concentrated on bigger issues in the system as forfeiture issue is headline catching but not an issue for 99.999% of leaseholders. The issue seems to always go back to the one leaseholder who had law forfeited by the fm freeholder leaseholders in his block. In that case the leaseholder disputed charges and it was found against him at Tribunal ? He had plenty of time to settle and failed and had only himself to blame. It’s a real shame that the facts are not being portrayed here correctly in that it is almost impossible to obtain forfeiture. This issue does not need to have any Governennt time wasted on it as there are far wider issues in the sector with affect many more.

It seems we have stirred up a hornets nest from a few in the sector. First a property manager wants to claim “total rubbish” and now you claim to report this matter is “hysteria”.

You then present what you say are “facts” but theses seem at odds with your own hyperbole with terms like “only themselves to blame.” (blame being mentioned 4 times in your comment) that gaining relief is “easy” and that “It takes a leaseholder who sits months on their hands and ignores all the issues to get to forfeiture””.

You then suggest it always goes back to one case. Surely as an objective reader of the site you must know that this is far from true there are many other case reported on this site including ones where forfeiture has happened before the leaseholder even knew there was an action. The Jackson case is always a particularly good example to mention becasue it shows just how many things can go wrong. The courts and tribunals messed up no less than 3 times one of which resulted in the President of the Tribunal writing a letter of apology.. Serous mistakes were then also made by Mr Jackon’s solicitor and that of his mortgage companies solicitor. Mr Jackson also made mistakes and we have never sought to hide that. One of those mistakes was believing information on the LEASE, Tribunal and government web sites at the time that legitimately led him to think his costs limited. Oh and then his co defendant happened to die the week before one of the hearings causing the appointed barrister to decide he needed to stand down -did the Tribunal allow a delay – of course not.

So this is not an argument for change becasue of one case but becasue there are many cases where forfeiture is risked and many many more where it is threatened. It is a issue where some in the sector have falsely claimed for years there is not a problem – based on no data. A bit like the sectors made up claim there were 2 million leasehold homes..

The data now shows we have 125 cases a year that reach a hearing they can give rise to a s146 action. At the moment we do not know. how many of these cases go on to actual forfeiture. becasue the Ministry of Justice have such poor recording systems.

To return to your “facts” you will know the various points. you raise.

1) Is a subjective view and the process is not as simple as you seek to suggest

2) The period of “many years” you mention for any sum outstanding is 3 years and of course the £350 has not changed since the amounts originally set in 2004 and are these amounts are unrelated to the value of the flat.

3) It is not always possible for a right to buy leasehold to find £50K in a month. It is also not possible for many other leaseholders to be able to pay the monies accumulated in the legal battles that sometimes happen in forfeiture cases. However as I mentioned above s131 of the Housing and Planning Act at last gives the courts and Tribunals powers to limit what they have sometimes described as “astronomical costs” that may stop some of the games played by the sector. .

4) Mortgage companies mess up and I am afraid homes are lost becasue they get things wrong. The rather dubious practices by certain lawyers contacting mortgage companies in debt recovery cases claiming a court decision when none exists is of course another matter..

I therefore return to my “hysterical” point. This is an issue which the Law Commission, The Law Society the Council of Mortgage lenders, lawyers and MPs and many others have felt should change. Forfeiture can and does result in unfair windfall profits for landlords. and some rather dubious practices by certain managing agents, landlords and solicitors.

It was proposed by the Law Commission we move to a forced sale system (one that addresses the money order matter raised by Sharon) . One which seeks to ensure the monies outstanding are paid or that the breach remedied or compensated for but in a way that removes the windfall profit and therefore at least some of the motivation for game playing.

Of course I accept that many managing agents and landlords do not play the forfeiture game but others do. Alison sets out her approach very clearly on her web site.

Martin

Your response again puts an unfair slant on his issue and we will not agree on this.

I am certain that out of the 125 cases you mention not one leaseholder lost the flat out rightly. I am afraid that I don’t share your sympathy for Mr Jackson. I actually share sympathy for the Leaseholders in the block who owned the Freehold and had to lay out sums of money to cover the proportion of service charges payable by Mr Jackson. Who did Mr Jackson expect should cover his service charges whilst he decided to dispute? Perhaps more sympathy would be given to him if he actually paid the charges and then made application to Tribunal. After all paying the charges does not prejudice his position.

“Interested”, you may be certain not one flat was lost last year, but the problem is you, and anyone else who comments that this is not an issue, are just speculating on the back of not having the evidence. The point of our getting the data of 125 cases per year is that it starts the process of knowing the numbers that form part of the system rather than just guessing.

Our experience is that there are a number of properties lost every year, in both the private and social sectors. One local authority advised us a few years ago they had the more than ironic policy of using the monies from properties that they forfeited to help those interested in right to buy.

Your position does not address the much larger issue of the threat of forfeiture being used inappropriately. In the past you have argued that the principle of the windfall from forfeiture is wrong, so I’m not even sure of the logic of your position. If I were to be setting out some of the naughty games landlords and managing agents play, I might start with the firm that used to employ Alison Mooney until 2011 …

I would fully agree Jackson should have paid first, and disputed later. This is the advice we give to everyone.

Unfortunately, Jackson only came to us much later in the process as his home was due to be forfeited. Accepting Jackson’s fault, it is also true that the reason the RMC leaseholders had to keep appealing is that they had no way to recover their costs after they lost the initial s27 case other than through asking for more funds from the members, who must also have overpaid their service charges. The only people to benefit from the legal arms race that followed in that, and other cases, were the lawyers.

Martin

Getting personal about Alison or her employer will not wash. Thanks for admitting you wrote an article making a fuss about forfeiture when you are not in possession of the facts. You can’t tell us how many of the 125 were forfeited. 125 out of the millions of leaseholders which you so proudly counted surely is a minor amount. I once again challenge you to bring facts instead of hysteria and hype. How many of the 125 were forfeited? I say not one leaseholder lost the flat to a so called unfair windfall to Freeholder. Then reason is because it’s almost impossible in the current system ( I outlined this earlier ) to obtain and sustain forfeiture. Your response with Jackosn was that his lawyers let him down. Perhaps the law on qualification of lawyers needs amending but forfeiture is not a problem . Any Government time spent on this would be a waste of taxpayers money. I regret that I prefer to look at the facts, and no doubt you will counter what I write here with more word play and manipulation of the facts but this will not convince anyone who understands the system. I am sorry but the forfeiture hype really lets you guys down and diverts you from the real issues.

You are going round in circles, bellowing: forfeiture is not wrong in principle, even the windfall element, and does not in fact happen.

Cube Real Estate was certainly alive to the problems of having Jackson’s flat on its asset book. It would have been transferred to it.

Nasrin Qureshi did lose her £165,000 flat to forfeiture, for which she paid cash. She lost the lot.

The windfall element does happen. No one involved in landlord and tenant law attempts to justify it. You do. But then you don’t believe it exists anyway.

You then criticise the only organisation researching into the subject.

And needless to say, you don’t offer any research you have done yourself. You are loud about your guesswork, instead.

I have some sympathy for Sharon dealing with a real pain of a leaseholder. She has been so tormented by him that she does not care about taking more off him than his established debt.

That is not right, of course, but it is an understandable sentiment.

Admin,

Perhaps if “Interested” found himself in a situation where for any reason he could not comply with the lease (perhaps he could no longer pay the service charges) that he forfeited his lease due to debts, and not only had his debts paid off as a result of the forfeit (which happens for every other debt) but lost his entire asset?

Would he then be emailing LKP asking for help?

Interested,

I disagree with you. The threat of forfeiture is held over leaseholders like the sword of Damocles, frightening leaseholders into submission.

If a leaseholder falls into arrears with their mortgage, the lender has the power to re-posses the property.to recover their debts. The remaining balance after the debt is satisfied is repaid to the former owner. . How can anyone justify a system that means a leaseholder can lose their entire investment?

A debt of 5,000 pounds can cost a leaseholder 300,000 pounds.

And that leaseholder is up against a freeholder that is probably offshore, employs a battery of lawyers and has a clear financial vested interest in forcing a forfeiture.

Sorry Micheal but you contradict yourself. On one hand you say that after debt is paid the balance is paid to owner and then say that a person loses his/her whole investment. The fact is they don’t lose investment and the fact is that to get forfeiture one needs to get first a determination ,and hence forfeiture is only powerful once one has determination. If a leaseholder does not pay a determined debt they only have themselves to blame. There is no flaw at all in the forfeiture system and its a waste of government time and resources trying to fix something that is not an issue. I am sorry but I don’t share the hype and hysteria portrayed here about this issue.

Interested,

Perhaps I did not make myself clear enough?. In the case of a mortgage default, the lender can re-possess the property. Let us say for example the debt is 25,000. The property is sold for 200,000 pounds and costs are added of 10,000 pounds.

The person who had their property re-possessed would receive 165,000 pounds.

The same scenario involving a forfeit of a lease would mean that the freeholder would not only get back their 35,000 pounds but they get to keep the other 165,000 pounds.

That is fundamentally unfair and contrary to natural justice.

A leaseholder faces a stiffer penalty than someone ordered to make repayments under the Proceeds of Crime Act!

Also what should be taken into consideration, that many freeholds came about from allowing a monarch to sleep with a lady he fancied hundreds of years ago, or more recently because an opportunity was seized upon whereby freeholds could be bought up for around 10% of what the leaseholders paid for their property.

So often the debts that lead to forfeit are less than was paid for the freehold..

Michael I understood what you said. My point remains unchanged. Forfeiture issue here is hyped into a major issue when it is not. I hope Government spends no time ion it. It’s a real shame that this insignificant issue which is rare is an issue being raised instead of tackling the real issues.

The letter from JB Leitch does not make sense?

Assuming the lease does not provide for a sublet, than clearly any sublet is in breach of the lease.

But, if the subletting has ceased, then the breach has been rectified.

This argument was put forward by JB Leitch themselves, when it was shown that when E&M claimed a ground rent increase based on a valuation they said had been carried out, when no valuation had been carried out. Eventually E&M were forced to do the valuation (as required by the lease)

JB Leitch successfully claimed in court that E&M had rectified the breach by subsequently carrying out the valuation.

The only claim might be if damage was caused by a tenant whilst a flat was sublet.

Hi Sharon

I have considerable sympathy with your predicament with one tiresome, game-playing leaseholder. There are certainly members of the awkward squad who simply will not pay money owed until they are made to.

But forfeiture of the total asset is disproportionate (although I can understand your vexation in this case). You should get the money that you are owed and your legal costs, not the total sum involved in this flat.

The comment poster “Interested” says that those who are forfeited have only themselves to blame.

This is nonsense in the Dennis Jackson case. Although he made a series of bad misjudgements in fighting his case, he was not responsible for the forfeiture.

After he lost his final hearing, forfeiture proceeding began about a month after the ruling. We successfully delayed this with an open access barrister, as he had not involved the Prudential, from whom he had an equity release mortgage.

This was the only likely source to lend Mr Jackson the £80,000 that he needed to pay.

Thereafter, LKP and Sir Peter Bottomley involved Prudential and the matter was put into the hands of its solicitors.

We thought this issue was finalised and that the lender would protect its loan. We did not even attend Wandsworth County Court. As it happened, a junior solicitor for Prudential had been sent to the court where she attempted to negotiate down the fees of the freeholder’s solicitors, which were, in fact, disgraceful. She was firmly told to go elsewhere, and the flat was seized.

I was astonished to be phoned that afternoon by Mr Jackson telling me he had had his flat forfeited.

We then involved Tidjane Thiam, the then CEO of Prudential, in order to have the matter taken seriously. Prudential seemed remarkably casual at the prospect of losing £160,000, which was its loan secured against the flat.

We were thrown out of the Wandsworth County Court at the hearing to reverse the forfeiture. Both hearings lasted little more than ten minutes.

I do not know anyone who is not concerned that this hearing, which decided whether or not to ruin Mr Jackson, was held in a closed court owing to the frivolous objection of the freeholder’s barrister.

There was an epilogue.

The CEO of the freeholder, Cube Real Estate, wanted to meet to explain itself and we did so in Sir Peter Bottomley’s offices at Westminster.

He wanted to assure us that Cube Real Estate had not wanted to take this flat from Mr Jackson (many of the legal costs had been run up by a management company, not Cube).

Fine, we said. But would Cube have given the flat back?

At this point, the CEO conceded that, with US private equity owners, it would have been very unlikely indeed that he would have been able to return some of this windfall to Mr Jackson.

Surely this sort of injustice – so unlike that of the fraudster Mr Waya in the criminal courts – needs to stop?

Interested: the threat of forfeiture is a regular tool used to intimidate gullible and vulnerable leaseholders into making payment of grossly inflated and more often undue sums.

Threat of the use of forfeiture is far greater than the thing itself. We all know Court/Tribunal determination must be obtained before forfeiture, but the constant threat of same is more often a money making scam and one that seemingly works, particularly when leaseholders selling and moving on find it easier to pay up to get out.

Attached is a case in point. In this case, after Judgement by Default was obtained [in a non-Geographic Court], application was made to Set Aside and obtained without difficulty, as the demand was totally without merit from the outset. However, it still appears as a B/F balance on annual GR demand.

Alec

We are not talking about the threat . we are talking about the fact that forfeiture is not realistic and never happens. You demonstrate here and strengthen my point. Even after judgment was obtained you managed to have it reversed. There are so many hurdles to pass before forfeiture would be granted that it takes months if not years of a leaseholder “sitting on their hands” .

I think Alec was saying that forfeiture is sometimes used as a money making scam, even if the contravention is minor or void and there is no hope of a positive judgement.

There are many gullible and especially vulnerable older people who will pay up just to avoid the hassle and there are a few unscrupulous operators who know this.

The vast majority of elderly chose this type of lifestyle hoping that it will be secure and stress free.

Of course they should pay all sums due, but management should never be able to create a situation from nothing whereby they are able to recover far more than is rightly due.

Interested this is going round in circles and I am afraid puts forward nothing more than a straw augment.

The article sets out very clearly that government and the courts have no accurate data on s146 forfeiture cases. It then sets out that we now say Tribunal data shows there are 125 cases on average a year that specifically give rise to the potential of a final s146 forfeiture hearing. These numbers will of course exclude a much large number of other cases which may be part of a Tribunal or County Court action,that can also give rise to the potential of a s146 action. They will also exclude the huge number of times the threat of forfeiture is used. Including those where sometimes dubious solicitors run up large no win no fee bills.,

To claim that such matters not relevant or that no forfeitures take place and only occur if the leaseholder is the blame is both subjective and wrong.

Instead of providing any evidence Interested seeks to argue that because we have said that government accepts it does not have a key part of the evidence that that somehow amounts to us admitting we have no information. even though the article sets out to highlight the data we do now have that did not exist before.. .

As the saying goes the absence of evidence is not evidence of absence..

Hi Sebastian,

I appreciate your reply to my post. Normally I wouldn’t even entertain the idea of forfeiture because of the potential expense, and the difference between the amount of arrears accrued against the current value of the property.

However, this lessee is also a landlord who is operating without a license. I am working with the local council on the issue but the process of enforcing compliance is time consuming as they collate the evidence in order to prepare a case.

He is also what the press coined a ‘rogue landlord’ and as I have been involved in dealing with issues raised by his tenant and the amount of legislation I have seen flouted, I am concerned that it is likely he will be operating illegally for the forseeable future.

I’m sorry I got off topic a bit here but the situation I describe highlights the fact that leasehold and the PRS are inexorably linked

This is why I am instructing forfeiture.

Well, it sounds like he is a complete pain and you do need powers to deal with him.

Our issues with forfeiture are different. As you know, there are loads of dodgy characters in the leasehold game, and they threaten forfeiture routinely.

I always assumed around 50 flats were forfeited, but I would revise that to closer to 70.

So it is a case of sometimes these freeholders get lucky. The case of Dennis Jackson is alarming: he had collapsed at the point that we made contact with him. He was no longer capable of defending himself alone.

There are others in similar positions. Flats can be lived in by lonely people; some are very vulnerable. Sometimes the flat is extremely valuable.

We are contacted by people who feel, I suspect rightly, that the ultimate end is to get hold of their flat.

Leasehold is unbalanced in the powers it gives freeholders, and forfeiture, with total loss of asset, is foremost in this.

As admin says,”there are a lot of dodgy characters in the leasehold game, and they threaten forfeiture routinely.”.

Interested: you appear to have a somewhat matter of fact attitude regarding the constant intimidation and harassment of gullible and vulnerable leaseholders by the unscrupulous few, primarily as part of a money making racket.

Earlier in this column, I referred to a 93 year old lady who died a few days after she received a letter threatening forfeiture under s146 unless she paid up.. The demand was for Buildings Insurance determined unreasonable [at three times the market] by the LVT. Consider this comment to the solicitor administering her estate.:

“In relation to your comments regarding the Leasehold Valuation Tribunal, I can advise that according to documentation received from the Tribunal, number…………………………………..was not party to the application. Therefore the determination does not apply to this property.

…according to our records no further adjustments need to be made to the account.”

At time of writing I am informed of a chap who forgot to pat his ground rent of £75 pa. In face of a demand for £461 within 10 days to “rectify the breach”, he is warned that unless paid: “when seeking to enforce Judgement, our Client will consider…our advice on the merits of forfeiture.”

This threat of forfeiture has become a racket.

Fortunately for him the ground rent issue was for 75 pounds pa. Therefore the debt was not too burdensome. Imagine if he had lived at the development that had, had the ground rent increased and backdated so that it was now 8,000 pounds pa?

Are leaseholders aware that if they purchase a leasehold property and the previous leaseholder has sold with service charges owing, the freeholder will simply pass the liability on to the new leaseholder.

So for a debt that had nothing to do with them, an innocent leaseholder can face a forfeit action unless they pay up.

Micheal you must have been reading the advice from Brady solicitors on leasehold assignment including the advice to their clients on how to avoid waiving the rights to forfeit.

The appropriately named solicitors JB Leitch .also offer “swift” advice on forfeiture. this firm have made not one but two false claims against me as the precursor for the usual threats of s146 action..

I say false becasue on one occasion they suddenly withdrew a demand for back ground rent payments sent to myself and a number of other leaseholders on the 20th December 2013 -what a nice Christmas present for some of the older residents at the site.

After a couple of robust phone calls on the 10th January Leitch suddenly advised::

“We have consulted with our Client who have withdrawn our instruction. They also advise that they will not be sending out any further correspondence.

We again apologies for any inconvenience caused”

On the other occasion I managed to get a CCJ removed just before it became final. Leitch had obtained judgment in default after they and County Estate Management had somehow accidentally started writing to the wrong address about half a mile from where I lived.. Only through utter serendipity did I happen to meet the person who lived at the “wrong” house about 5 days before the CCJ became final.

A JB Leitch “barrister” attended a new court hearing and warned me to give up before we started if I wanted to avoid his additional costs. He still argued I was in default even though they had used the wrong address. Fortunately the judge threw out the case.

Of course there is no chance of getting back my costs as a leaseholder in either case

It may have been complete coincidence County Estate Management (who by then were owned by Peverel) started using the wrong address to send my service charge demands not long after we began taking action that would go on to our Tribunal hearings to remove them as managers and then recover half a million pounds in overcharged bills and then buy the site..

Of course if I had not met the person from the “wrong house” the CCJ would have been enforced an I would not have known and I would also not have known about the s146 that could have followed. .

.

How is this for a JB Leitch practice?

I was in dispute with them myself many years ago.

Suddenly everything went quiet. i contacted JB Leitch to be told the reason was that the solicitor’s mother had passed away, so he would be off work for a while.

I sent an email expressing my condolences and said that” family comes first and whatever our differences he should take all the time he needs and that I would wait until he was ready to resume work”

JB Leitch charged me for this email!..

HI Admin.

Appreciate your comments.