Here is a good example of how the sector – that blob of property interests, from builders to offshore investors – view swathes of peoples homes in leasehold England.

Here is a good example of how the sector – that blob of property interests, from builders to offshore investors – view swathes of peoples homes in leasehold England.

In 2012 Savills analysed the ground rent market, and did a pretty good job.

Under the title, ground rents “An unusual yet attractive investment” the giant estate agency / asset manager said:

“Ground rents are not conventional real estate investments. Whilst owning a ground rent brings with it both rights and responsibilities that are shared with owners of other forms of property, ground rents have some unique characteristics.

“These come together to produce an investment that is unusual in the property sector, but which can be very attractive …

“The income for the owners of ground rents comes through the operation of leases under which there is a commitment to pay low levels of rent for typically 125 or 999 years …”

This was written before LKP revealed the scale of doubling ground rents from the likes of Countryside Properties plc and Taylor Wimpey.

And Allsops, too

Reversionary ground rents in 2017 – an oldie but a goodie – Allsop

From the vantage point of the rostrum, in unprecedented economic times with historically low interest rates and persistently low inflation, the reversionary ground rent market (freehold ground rents sold subject to shorter residential leases) has been quietly picking up momentum in recent years. And why not?

Savills report continues: “Because the ground rent is usually a nominal sum, the leaseholder is incentivised to pay under the threat of losing their property if they fail to do so and therefore the risk of default is minimal.”

Of course, with these aggressive ground rents the risk of default is far higher.

“In the event of a leaseholder default, the leaseholder’s mortgagee will typically pay to avoid forfeiting their security and should there be further default, the freeholder has the right to forfeit the lease and gain vacant possession of the property. Default is therefore extremely rare.”

Actually, this is just a guess. A parliamentary question from Labour MP Emma Reynolds was pushed aside as “too expensive” to find out about forfeiture.

Martin Boyd, LKP trustee, then rummaged around Ministry of Justice archives to find 130 forfeiture cases are brought, so we can guess around 65 cases a year are granted.

Dennis Jackson lost his £800,000 leasehold home in 10 minutes flat over a £7,000 debt that lawyers had shamefully parlayed into £80,000.

SCANDAL: LKP stops forfeiture of £800,000 flat … over a £7,000 service charge dispute

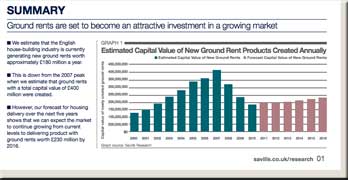

Savills estimated the ground rent market at £180 million in 2012, down from £400 million at its peak in 2007, during the boom.

It predicted a market of £230 million new freeholds sold off by 2016, and predicted strong growth.

Savills was right. LKP reckons the figure is higher. From developer annual reports, we reckon that between £300 and £500 million of freeholds are sold by developers every year. The figure has been widely reported in the national press.

Allsops, again

Ground rents – where are the opportunities? – Allsop

About 20 years ago, Dorrington’s Residential MD Trevor Moross, then President of the British Property Federation (BPF), asked me to his office to discuss the cumbersome sales mechanism for ground rents dictated by the Landlord and Tenant Act 1987. Basically, landlords wishing to dispose had to offer their interests to their lessees first at a fixed price.

And again

Ground Rents for Sale: Buy as Investment

It seems that the Government is doing everything it can to make life difficult for the buy to let investor. First the phasing out of higher rate tax relief, then a 3% hike on stamp duty. And even if that hasn’t deterred you, London prices have risen significantly making investment in many parts of the capital expensive.

Leasehold houses have at last got the scandal of ground rents into the nation’s consciousness. But this is much worse …

Leasehold houses have at last got the scandal of ground rents into the nation’s consciousness. But this is much worse …

Roger Southam is a director of ‘SAVILLES’ a company whose views on Ground rents are for all to see. Southam s Wife’s association with Ground rent portfolios is well documented. WHY was Southam appointed Chairman of ‘LEASE’? There is something fishy on the state of Denmark. Let us all be relentless in getting rid of this stench. You can contact Southam via his ‘SAVILLESs’ blog.

You have to wonder why any government needs a consultation process to understand the scandal of leasehold.

They just have to read the Allsops “Spotlight on Ground Rents” (can you can hear Maggie’s minnie-me Arthur say “nice little earner, Terry”?)

“Secure income stream

The income for the owners of ground rents comes through the operation of leases under which there is a **commitment ***to pay low levels of rent for typically 125 or 999 years. Because the ground rent is usually a nominal sum, the leaseholder is ***incentivised to pay under the threat of losing their property if they fail to do so**** and therefore the risk of default is minimal.

In the event of a leaseholder default, the leaseholder’s mortgagee will typically pay to avoid forfeiting their security and should there be further default, the freeholder has the right to forfeit the lease and gain vacant possession of the property. Default is therefore extremely rare”

And the nice part is these fleeceholders can have their investment taken off them for a debt of £350. Quite right too.

Leaseholders are literally seen as enclosed fattening sheep left to graze until the next shearing.

My old country rebelled (any excuse to be fair but warranted) against these landlords but it took the “Free State” to crack the problem with tenants enabled to buy out their ground rents and effectively change a long lease into a freehold interest,

We need an English rebellion! Peaceful, mind. We all have properties to protect. Just make sure the spuds are well tended while we’re off marching.

.

Can’t help feeling a lot of Parliamentarians in both houses subscribe to these investor reports.

I’m off to nibble some grass… baaaa

Can one ever get too much of a good thing? One is finding the Allsop blog archive rather bad for one’s blood pressure, like finding oneself a lone Canary at Portman Road:-

http://www.allsop.co.uk/media/why-not-consider-buying-ground-rents/

Quite interesting topic, but more so for the sage advice at the bottom:

“As with all property investment, homework is so important. If you’re new to this, the best advice is to get advice. For some useful guidance go to http://www.lease-advice.org”

Could this be the same LEASE that takes the side of leaseholders?

Then there is advice that, frankly, one doesn’t fully understand but feel certain one wouldn’t be happy about if one did:

http://www.allsop.co.uk/media/dont-let-your-rent-review-clause-drag-your-rent-down-draft-with-care/

Regarding maximising one’s investment:-

“But how good that opportunity is for the landlord is set at the start of the lease, by the legal wording contained in the rent review clause, drafted by a solicitor.”

“This is because the assumptions contained in the rent review clause can over-ride the principle provisions of the lease. ”

Regarding needing a rent review surveyor:

“He can advise on what the clause needs to achieve in rental terms – namely the creation of a favourable negotiating position for the landlord at future rent reviews. In fact it goes further than that, it can also affect the renewal lease on expiry where the rent review clause is generally imported from the old lease.”

One feels rather a chill. Shan’t return there again, do you see. Do you, really?

One simple way forward would be to make it a requirement in the prescribed clauses of the lease to state what the ground rent provisions. Further the rent to be valued on a NPV (i.e. Net present value ) using a statutory capitalisation rate

Had my idea been in place these doubling ground rents would never have been accepted as the term would have been stated clearly in the summary provisions of the lease and its capitalised value would have shown how serious the problem was